In the last briefing, we highlighted the power of compounding. Here we outline the other factors that are important to ensure that the ‘compounding’ effect is maximised.

First, let the power of compounding do its work but by diversifying your investments (investing in a range of assets and holdings and by selecting different managers/funds that have different approaches/areas of expertise) the volatility of your portfolio should diminish. This should help ensure the drawdowns (declines in value from the previous peak) are less exaggerated thus making it easier to catch up again when the market rises.

Second, review your managers/funds’ performance on a regular basis. You can compare them against other similar managers/products and don’t forget to look at them relative to the market indices (remembering they don’t have any charges deducted). Investors continue to debate whether ‘active’ managers who seek the ‘best’ investments can add value compared with their ‘passive’ counterparts who do not select stocks, but whose performance simply reflects the movements in the relevant stock market. In our view, there is room for both in any investment portfolio.

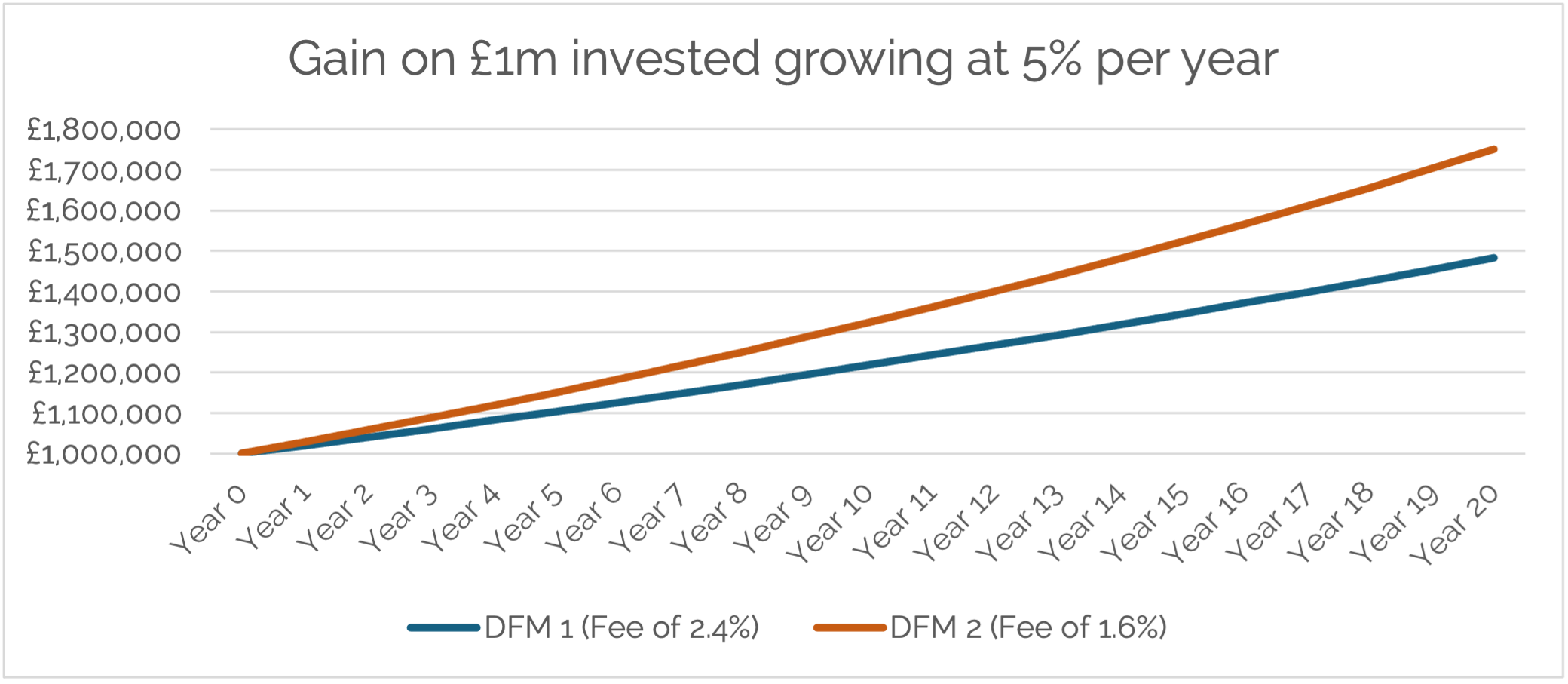

Third, pay attention to your costs particularly those paid to the investment managers by examining the OCF (ongoing charges figure) which includes almost all costs and charges including the management fee. Even fractions of a percent can make a significant difference to returns over the long term. In addition, look at the fees your ‘platform’ or custodian are charging for holding your investments.

In Part Three of this series and as we celebrate International Women’s Day on Friday 8th March, we will highlight some ways that investors can ensure they do not miss out on the potential returns from a well-managed investment portfolio and the compounding advantages this can bring.

As before, If you would like to discuss this or any other aspect of investment please contact Philippa Armitage (Philippa.armitage@strabenshall.co.uk) who is a Senior Investment Director on the Investment Consulting Team or your Strabens Hall financial advisor. We would be delighted to hear from you.

Strabens Hall Ltd is authorised and regulated by the Financial Conduct Authority (“FCA”). Our FCA registration details are set out in the FCA Register under firm reference number 461795 (www.fca.org.uk). Strabens Hall Ltd is registered in England and Wales (registered number 06015275) and our registered office is 5 – 9 Eden Street, Kingston upon Thames, Surrey, United Kingdom, KT1 1BQ.

Some of our services are not regulated by the FCA. Before you engage us in any work, we will outline which of those services are and are not regulated by the FCA to enable you to make a fully informed decision.

The Financial Ombudsman Service (FOS) is an agency for arbitrating on unresolved complaints between regulated firms and their clients. All complaints for referral should be submitted to Strabens Hall Ltd prior to approaching the Financial Ombudsman Service (FOS). Full details can be found on its website at www.financial-ombudsman.org.uk.