When it comes to helping people achieve their financial goals, our Senior Client Director, Linda Kozlowska, tells us that the financial planning and analysis process or simplistically – cash flow planning – is “an invaluable tool.”

She recommends it to all her clients because it allows them to see a graphic overview of their current situation: assets and liabilities; cash inflows versus outflows. In an easy to understand chart, it shows them how her recommendations can help them achieve their objectives and if their objectives are achievable with their resources and spending habits.

How much can you afford to spend for the rest of your life?(Financial planning & analysis holds the answer )

This may sound like something that a business should concern itself with, but as these examples will reveal, both are incredibly useful for personal finance planning, too. They assist in the decision-making process, allowing you to see potential outcomes (crucially) before you make your choice.

Some common situations my clients have found themselves in that have benefited from this analysis;

Estate planning

From who inherits your home to appointing a lasting power of attorney (LPA), estate planning helps you determine how to distribute your wealth during – and after – your lifetime. One of the most common questions that I encounter is, “can I afford to make gifts to my children and, if I do, how might it impact my long-term financial security?”

We call these “What if” scenarios – and preparing a plan with a variety of outcomes makes it easy to demonstrate to my clients how their decisions can impact their wealth – and their loved ones’.

Financial planning for divorce

When it comes to the divorce process, many people focus heavily on securing legal advice. While this is incredibly important, getting financial advice and support is also crucial.

Many of my clients need to determine the maximum level of expenditure that their capital can support long-term. Cash flow planning and financial planning analysis can help them find their answer. From pension contributions to splitting assets, the right financial advice can help to reduce monetary stress throughout this very difficult – and overwhelming – time in life.

Retirement planning

Retirement planning is not just for people who want to retire early. It benefits anyone who wants to ensure financial security once they have left the workforce.

For some, advice and financial planning exercises may highlight the fact that they need to save more for retirement. In such cases, an accumulation strategy is advised, with analysis that focus on the impact of increasing contributions immediately. Others, however, may find that they need to follow a deccumulation strategy. In this case, I recommend cash flow planning to show which sources of capital should be used to fund retirement, and in which order these sources should be used.

Tax planning

From capital gains reliefs to planning for – and minimising – inheritance tax, tax planning helps individuals legally reduce their personal tax liability. I work with my clients using our specialist in-house financial planning software to demonstrate how their implementation can positively impact personal tax expenses.

Investment planning

Our financial planning analysis software has never been more useful in helping people understand how much risk they can afford to take in their investment strategies. The “what if” scenarios visually highlight the potential returns that can be achieved – and the level of expenditure that can be covered – based on the amount of risk assumed. Hugely helpful for those new to investing, who need to understand the value of risk.

These types of exercises are also used regularly to help clients see how certain events may impact their portfolio – and their bank balance. For example, understanding the effect of uncertainty or economic downturns on portfolios, caused by ‘unknowns’ such as Brexit or pandemics

How cash flow planning works

As with all financial planning services, before you can reap the benefits of cash flow planning, you must first define your financial goals. What is it that you want to achieve with your money, and when do you want to achieve it?

Our step by step guide helps you to formulate the initial plan:

Two big questions to answer at this stage of the process:

- where is your money coming from (for example, salary, bonuses, investments)

- how is it being spent?

The outcome of each “what if” exercise allows us to see how certain decisions and events may impact your wealth.

The following examples provide insight into the use of asset and cash flow charts.

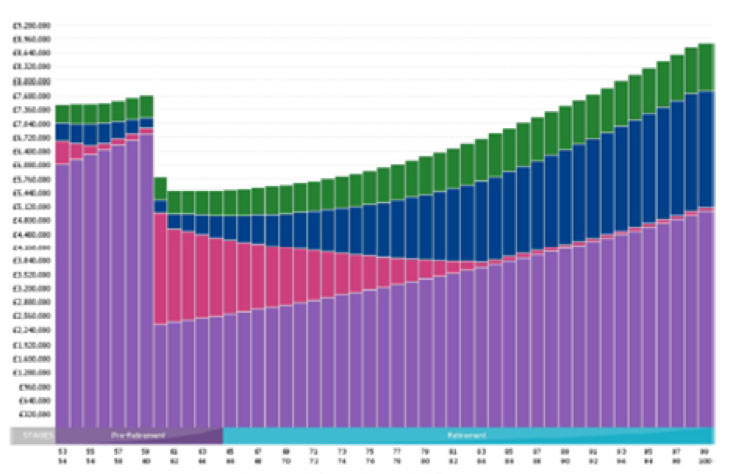

Example #1: The asset chart – client example: Mr & Mrs Jones

The asset chart above shows how this couple’s assets will change over time. Each asset is represented by a different colour, with changing amounts visually communicating which assets will be sold, how they will grow and those that will be spent or depleted over time.

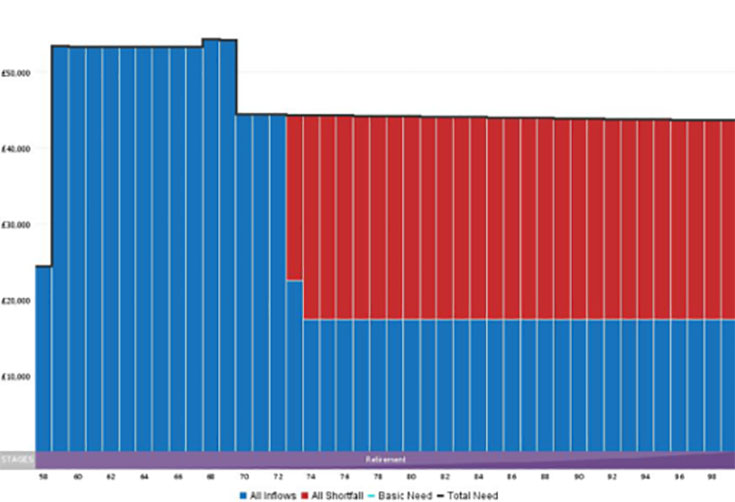

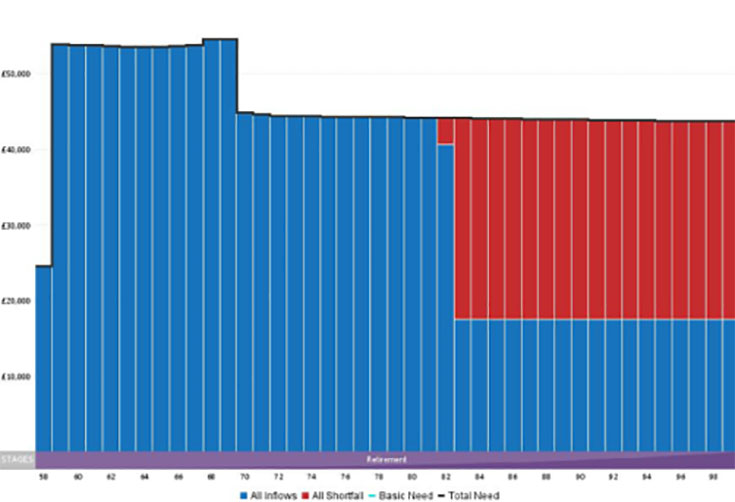

Example #2: Cash flow charts – client example – Mr Langley

My client in this example has now retired. He has a lump sum of money and wants to know, “is my current level of expenditure affordable and when will we be likely to face a shortfall?”

The red bars in the charts reveal a shortfall. His current level of expenditure (‘before’ chart) is not affordable.

In this scenario our advice was to allocate holdings more cost and tax efficiently, to potentially delay the shortfall by nine years (‘after’ chart). With this plan, we were then able to quantify his maximum sustainable level of expenditure until a given age.

“The specialist financial planning and analysis software we use is hugely helpful to me as an adviser, and my clients tell me time and again how useful these predictions and images are in helping them to understand and plan for themselves. This is a part of the job I really get to enjoy, where I can physically demonstrate financial planning and see my clients reap the benefits”

Getting started with financial planning and the cash flow process

If you’re ready to take control of your finances and start achieving your financial goals, contact the Strabens Hall office to make an appointment with one of our financial planners here in London or Nice.

Strabens Hall Ltd is authorised and regulated by the Financial Conduct Authority (“FCA”). Our FCA registration details are set out in the FCA Register under firm reference number 461795 (www.fca.org.uk). Strabens Hall Ltd is registered in England and Wales (registered number 06015275) and our registered office is 5 – 9 Eden Street, Kingston upon Thames, Surrey, United Kingdom, KT1 1BQ.

Some of our services are not regulated by the FCA. Before you engage us in any work, we will outline which of those services are and are not regulated by the FCA to enable you to make a fully informed decision.

The Financial Ombudsman Service (FOS) is an agency for arbitrating on unresolved complaints between regulated firms and their clients. All complaints for referral should be submitted to Strabens Hall Ltd prior to approaching the Financial Ombudsman Service (FOS). Full details can be found on its website at www.financial-ombudsman.org.uk.