In our previous two briefings, we looked at the power of compounding and what investors should focus on to ensure they maximise its benefits.

Now it is time to ensure that women who may not always be in full-time work, and their families can take advantage of this phenomenon.

First, many women (writer included) take time off from a full-time professional career to fulfil family obligations. This can be temporary or permanent and during this period, they will not have the advantage of an employer pension contribution. However, even if not earning, women can continue to pay into a pension (SIPP) up to £3,600 gross per annum. In fact, anyone can contribute into a SIPP up to this amount even as a child and it is good to start early to see the compounding effect really at work.

Second, everyone can contribute towards an Individual Savings Account (ISA) or a Junior Individual Savings Account (JISA) each year. This will not benefit from the same Government contribution as a pension but it is another way to allow your savings to grow tax free. There is also the added advantage that as an adult there are no age restrictions or tax on withdrawal. However, there are limits on the contributions you can make.

Third, if someone is at home, looking after children under twelve years old and has claimed Child Benefit (even if, for tax reasons, they have said they do not want to receive this) then these years should be recognised by the Department for Work and Pensions (DWP) and count towards their state pension. If this has not happened then they may be able to claim for these years retrospectively.

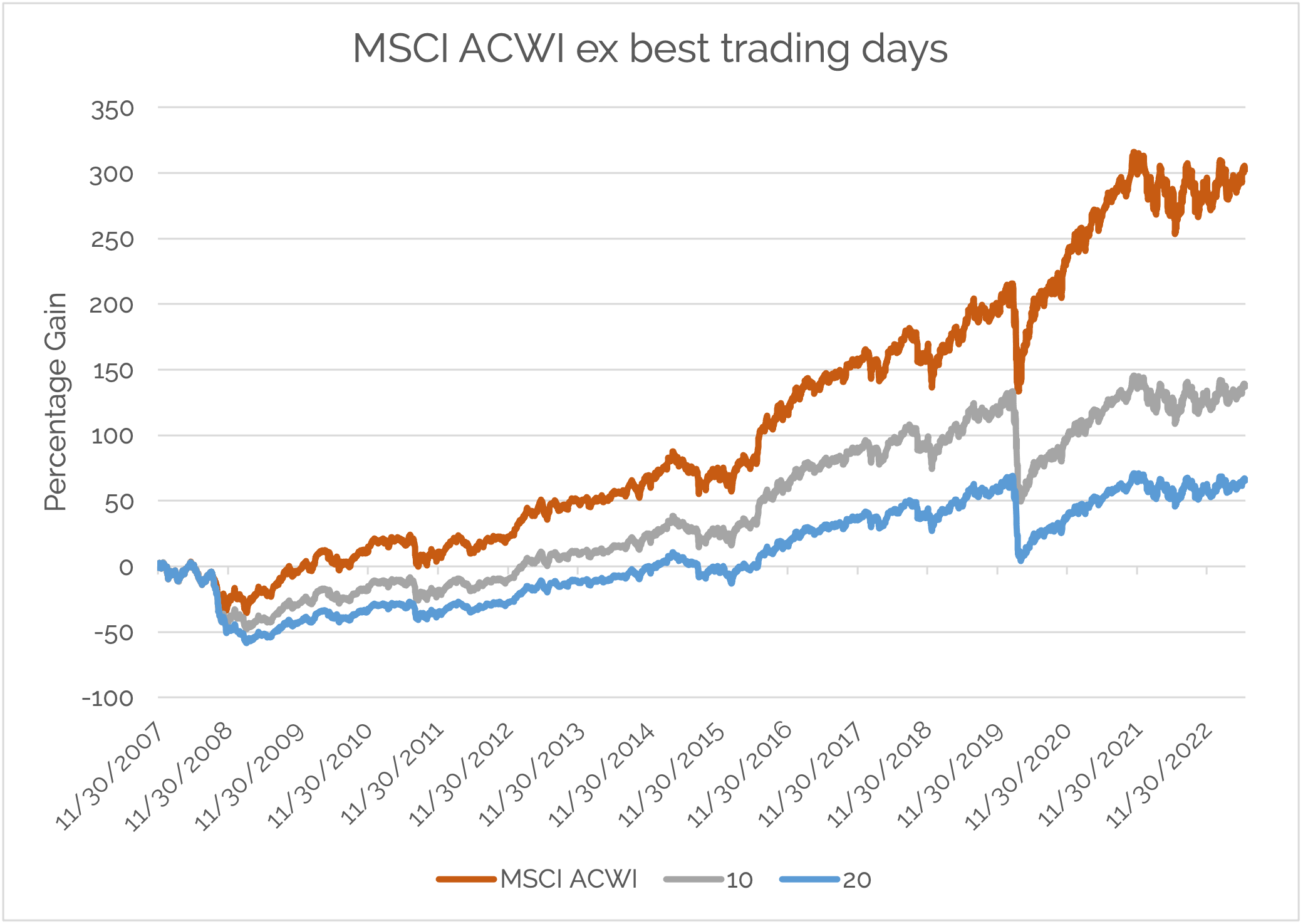

Finally, it is important to take charge of your investments and plan for the future. No one can predict how markets will perform and often the best performers one year are the worst the next. However, it is important to get started. It is not about ‘timing the market but about the time in the market’. Please see the chart below showing the impact of missing the best ten or twenty trading days on your returns.

At Strabens Hall, we have a dedicated Investment Consulting Team who advise clients on the best way to manage their portfolios.

As before, If you would like to discuss this briefing or any other aspect of investment please contact Philippa Armitage (Philippa.armitage@strabenshall.co.uk) who is a Senior Investment Director on the Investment Consulting Team or your Strabens Hall financial advisor. We would be delighted to hear from you.

Strabens Hall Ltd is authorised and regulated by the Financial Conduct Authority (“FCA”). Our FCA registration details are set out in the FCA Register under firm reference number 461795 (www.fca.org.uk). Strabens Hall Ltd is registered in England and Wales (registered number 06015275) and our registered office is 5 – 9 Eden Street, Kingston upon Thames, Surrey, United Kingdom, KT1 1BQ.

Some of our services are not regulated by the FCA. Before you engage us in any work, we will outline which of those services are and are not regulated by the FCA to enable you to make a fully informed decision.

The Financial Ombudsman Service (FOS) is an agency for arbitrating on unresolved complaints between regulated firms and their clients. All complaints for referral should be submitted to Strabens Hall Ltd prior to approaching the Financial Ombudsman Service (FOS). Full details can be found on its website at www.financial-ombudsman.org.uk.