We consider ways of maximising tax efficient savings for children . . .

We consider ways of maximising tax efficient savings for children . . .

When advising clients on tax efficient saving for children and grandchildren there are a number of options worth considering including NS&I Children’s Bonds, Premium Bonds, Friendly Society Savings Plans and of course the Junior Individual Savings Accounts (JISAs).

This article focuses on the JISA which was launched in 2011 and effectively takes over from the Child Trust Fund, the government flagship saving scheme launched in 2002.

What is a Junior Individual Savings Accounts (JISA)?

The JISA allows parents, relatives and friends of the family to save cash or shares and funds, free of income tax or capital gains tax, for a child until their 18th birthday, upon which the JISA will be transferred into an adult ISA.

Stocks, Bonds and Cash?

A combination of assets including cash, government bonds, corporate bonds and shares can all be held in a JISA. Given that children are best placed to take advantage of the long-term performance of the stock market and cash returns are so low, the JISA is an ideal investment vehicle for those with a long term view.

Taking the Long-term View

If started early enough, a JISA can have a meaningful impact on the finances of the investor. JISAs are also an extremely good way of involving the younger generation in saving and investing from a young age and, we would hope, lead to some form of financial awareness and independence further down the line. Despite the risks, stock market investing can be fun and dare we say interesting. One only has to look at how interested the younger generation are with sectors such as technology, food, and the environment to see just how much, even from a relatively young age, investing could engage young people.

The Detail

Until the child is 16 the JISA is managed by ‘The Registered Contact’, a parent or guardian. Access is restricted until age 18 at which point the child can choose to take some or all of the money out of the JISA; any funds remaining will roll into an ‘adult’ ISA.

In the current (2017/18) tax year, the maximum contribution that can be made into a JISA is £4,128 and this increases annually in line with the Consumer Price Index (CPI). The annual allowance can be allocated, in any proportion, between a cash JISA and a stocks and shares JISA.

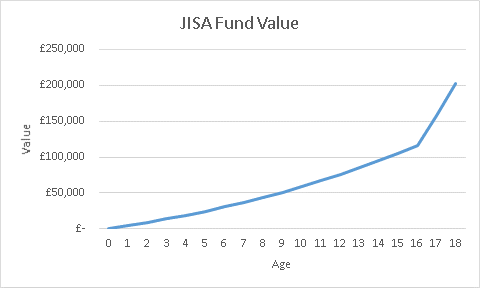

If a grandparent opens a JISA for a grandchild born in 2017 and contributes the maximum annual JISA allowance each year the value will be £139,900 on the child’s 18th birthday.

What Else?

Cash ISAs are available to individuals aged 16 or over. As a result 16 and 17-year-olds can also contribute £24,128 into ISAs in the current tax year meaning that they get two allowances

- a £4,128 JISA allowance (Cash and/or Stocks & Shares) and;

- a £20,000 adult ISA allowance (Cash only)

Although not an option for most 16 and 17 year olds, for those lucky enough to be able to make an ISA contribution, the long term benefits are again potentially significant.

Careful planning goes a long way – an example

If a grandparent opens a Junior Individual Savings Accounts for a grandchild born in 2017 and contributes the maximum annual JISA allowance each year the value will be £139,900 on the child’s 18th birthday. This assumes that the annual allowance increases annually with inflation and that the JISA is invested in a portfolio which generates a return of 4.5% per annum after fees. The result is depicted in the chart below:

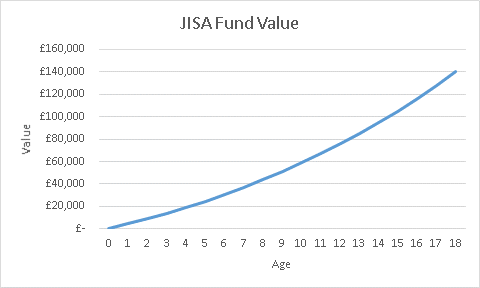

Based on the same assumptions as above, if the child’s cash ISA allowance is then utilised when they are 16 and 17, the fund value of the ISA at 18 will then jump to £202,900, as illustrated below:

2.5% per annum, as stipulated by our regulator the FCA

Inflation plus 2%: Strabens Hall’s target return for a balanced portfolio over the long-term.

We have assumed that the interest earned on cash is equal to inflation

The total amount accumulated at age 18 would therefore be £202,900, an 86.5% return on funds invested based on the assumed growth rates detailed earlier in the article. As you can see, saving for a child using both a JISA and, at a later stage, a cash ISA can potentially mean financial independence and security for grandchildren as they head off to university and beyond.

One point to note is that for both grandparents and parents looking to make contributions, it is worth seeking advice as there could be an inheritance tax implication when making contributions and these should be considered before any action is taken.

To summarise, if you are comfortable with your child taking control of the ISA at age 18, both the JISA and later the ISA could form part of a wider plan that, with a relatively small annual financial contribution could provide children with a significant and tax efficient fund for the future.

As we mentioned at the start of the article, Junior Individual Savings Accounts aren’t the only option but it is certainly one way of reaping the rewards of tax free savings and the long-term compound returns of investment markets.

Disclaimer

- This article is based on our understanding of current legislation which may change in the future

- The figures shown are examples only. Actual returns could be higher or lower

- No part of this article should be taken as an invitation to invest or as financial advice.

- We strongly recommend that before making any investment decisions your seek advice from an Independent Financial Adviser which is authorised and regulated by the Financial Conduct Authority

Linda Kozlowska, Senior Client Adviser, Strabens Hall

Strabens Hall Ltd is authorised and regulated by the Financial Conduct Authority (“FCA”). Our FCA registration details are set out in the FCA Register under firm reference number 461795 (www.fca.org.uk). Strabens Hall Ltd is registered in England and Wales (registered number 06015275) and our registered office is 5 – 9 Eden Street, Kingston upon Thames, Surrey, United Kingdom, KT1 1BQ.

Some of our services are not regulated by the FCA. Before you engage us in any work, we will outline which of those services are and are not regulated by the FCA to enable you to make a fully informed decision.

The Financial Ombudsman Service (FOS) is an agency for arbitrating on unresolved complaints between regulated firms and their clients. All complaints for referral should be submitted to Strabens Hall Ltd prior to approaching the Financial Ombudsman Service (FOS). Full details can be found on its website at www.financial-ombudsman.org.uk.